This week we will tell you about the agency which provides the credit score of our borrowers. We use the expertise of CRIF High Mark.

High Mark was founded in 2007 and received a Certificate of Registration from The Reserve Bank of India to operate as a Credit Information Bureau in India in 2010. In June 2014, CRIF, a leading global company that specializes in the design, development and management of credit reporting, business information and decision support systems for Consumer & Commercial Lending, acquired a majority stake in High Mark.

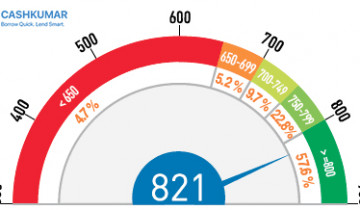

Highmark scores range from 300 to 850 (a score of 720 and above considered excellent). At Cashkumar, we only lend to borrowers with a credit score above 500. That said, credit score is one among the many factors that decide whether or not someone gets a loan and the loan size.

When you log into your lender account and browse a borrower’s profile, you can see the range under which his/her score falls.