A large number of people need loans for various reasons. It may be required to purchase high value assets like a car or a house or for expenses like travel or marriage. You can know more practical things about marriage and travel loans here and here. However, a number of loan applications are rejected because the borrower has a bad credit history. In this article, we look at what is credit history, what can make it bad and how to get a loan if you have a bad credit history.

A large number of people need loans for various reasons. It may be required to purchase high value assets like a car or a house or for expenses like travel or marriage. You can know more practical things about marriage and travel loans here and here. However, a number of loan applications are rejected because the borrower has a bad credit history. In this article, we look at what is credit history, what can make it bad and how to get a loan if you have a bad credit history.

Credit history

In order to understand credit history, one needs to look at loans from the point of view of the lender. A lender wants to earn money by giving it on interest to the borrower. The prime worry of the lender is that the money should not be lost. If the loan has a collateral – like a car or property, this is not a major worry since the lender can take possession of the collateral and sell it to recover the loan. However, if there is no collateral – like in a personal loan, then the lender is more worried. The borrower hopes to pay back the loan from the future income but factors beyond his control – like a recession, job loss, medical issues etc. can curtail his ability to pay. So such loans are risky from the lender’s point of view and hence they charge larger interest. You can read more about interest rates on our well researched page. Further, there are some borrowers who take a loan without any intention to pay back. The lenders want to avoid such borrowers.

The credit history is a prime tool for the lenders to decide how risky their loans are. Basically the credit history is just a statement of what past loans the borrower has taken and how they were repaid – whether repayment was late, only a part payment was made and so on. If you have not made payments in time or a loan has been unpaid, it reflects very poorly and new lenders will not want to give you loans.

Cibil

In order for the credit history to be meaningful, it must be comprehensive. Further, it must not be possible for the borrower to hide things. Otherwise the whole purpose of a credit history will be rendered meaningless. Hence there is a need for all the lenders to collaborate and bring together their data. In order to do this, an organization called Cibil has been formed. It collects data from a very large number of lenders – banks, financial institutions and so on. This data is regarding all the loans that they have given out. The customer identity is matched using some number like the PAN no. Since the data goes directly from the banks to Cibil, it is not possible to hide anything.

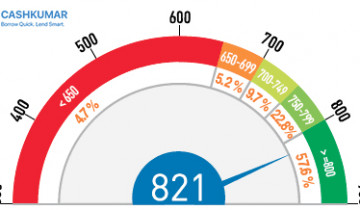

Further, Cibil also aggregates all this data into a single number that it calls the credit score. The credit score ranges from 300 to 900 with 300 being the worst and 900 the best. Typically 750 is a reasonable score and it is difficult to get a loan if your credit score is below 750.

Checking your Cibil score

Cibil allows borrowers to check their credit score. It also allows access to the credit history via a credit information report. These can be obtained by paying a charge of Rs 500. In order to access the same, you can go to Cibil’s website and fill this online form. After filling the form, you need to make the payment. If the payment is made via a credit card in your name, no more authentication is required. Otherwise you need to answer some questions to authenticate yourself. Once this is done, you can immediately access your credit score and the credit information report.

No credit history

At times, you may not have a credit history. This may happen if you have no credit cards and have availed of no loans. Sometimes you may have availed a loan from an institution that is not a Cibil member. In such cases, since you have no credit history, it may be difficult for you to avail loans when you need it. So it may be a good idea to get a credit card and use it for your monthly purchases. Please do remember to pay your dues in time as otherwise it may reflect poorly on your credit score

Bad credit history

If you have a poor credit score cause by bad credit history, you will face issues in getting loans. So it may be a good idea to work towards improving your credit score.

Figure out the problems

The first step is to really understand what caused the bad history in the first place. It could be because of financial difficulties or oversight / forgetting to pay EMI on time. Click here to know how EMIs are calculated.

Solve the problems

Once this is identified, you need to solve the issues. If there are financial difficulties, you need to create a financial plan to manage your finances better. If you are not confident of getting it done yourself, you need to take help from a financial advisor. If you also continually keep missing your financial goals or are unable to pay EMIs in time, you should take help from a financial advisor. It may be the case that you are missing some things while making your plan and hence are unable to follow it.

Typically, a financial plan will ensure that your EMIs are henceforth paid on time and you have a cushion or emergency fund so that you do not fall in debt again.

In case the issue was due to forgetfulness in paying EMIs etc., you need to setup reminders to pay these on time. Also, rather than waiting till the last moment, it is better to pay it as soon as possible so that even if you forget once, you still do not miss the deadline. Lastly, some of the credit cards and loans have a facility to make reminder calls / SMS or email.

Monitor your score

If your plan works out then you will see your credit score stabilizing if not improving. Over time, as the incidents that caused the problems become older, your score will improve.

Improve your score

In order to improve your score, you need to show that you repay loans on time. If your score is too low, it will be difficult to get personal or collateral free loans. In such a case, you can try to begin by repaying your credit card loans on time. Also, you can take up loan against property or assets (like gold or car). Building a good credit history will increase your credit score but do remember that it takes time.

Loans with a bad credit history

If you have a bad credit history and want a loan urgently, you have very few options. You could try to take a loan under your spouse’s name. Some smaller cooperative backs have not yet tied up with Cibil and you can try to get loans from them. You can also try to get loans from friends and family.

Contributed by our friend

Nirmesh Mehta

Nirmesh is a finance professional, consultant and avid writer popular for his blog Personal Finance Musings. You can know more about him here and follow his blog here for more tips on personal finance.