Personal Loans has become extremely significant in the life of all individuals in today’s fast paced world. These loans fulfill many needs of the individual without disturbing their savings and investments. Previously, obtaining any kinds of loans from -nationalized or private banks in India used to a very tedious and time consuming process. But with the advent of new age technologies such as the internet, these processes too have undergone transformations. They are much more easy, simple and within the grasp of every educated individual. At present, an individual may, through putting in a little effort and time, is able to find all the available ways and means of obtaining a personal loan and at the same time settle for the best deal for oneself.

The most important factor when considering taking out a personal loan is the determination of the EMI or equated monthly installments. The amount of EMI to be payable to the bank during this designed tenure is very vital to an individual taking the loan. To determine the EMI, there are three vital factors which are necessary to be outlined at the very onset, namely,

- The amount of loan required

- The rate of interest payable on such loan

- The period of loan repayment.

When these outlined criteria are available, then calculating the EMI becomes very simple. EMI Calculator for personal loan are available on several banking and financial websites which helps the individual to determine the EMI amount that is payable of taking out a personal loan of the required amount by an individual. The process followed by these Personal EMI calculator is very straightforward and can be of use to anyone seeking to borrow from a financial institution in India.

Even individual banks have their own EMI calculators for personal loans which may also be used by an individual.

With the help of these personal loan EMI calculator a borrower can determine the EMI most suitable to an individual by varying the inputs to the Personal loan EMI calculators.

While the eligibility criteria may differ, there are some general parameters followed by the majority of banks in India which may assist the individual to be able ascertain the EMI amount of their required personal loan.

The key inputs are:

- Principal Amount of Loan

- Rate of Interest

- Period of Repayment of the Loan

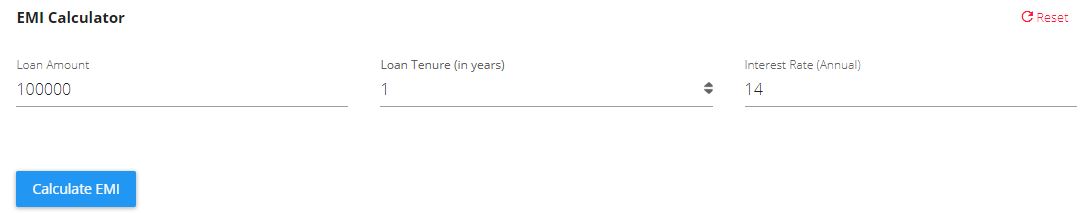

Once these inputs are inserted into the given online fields, calculating the EMI is a relatively uncomplicated procedure. In fact, via the online personal loan EMI calculator, the EMI amount payable is automatically calculated and reflects on the screen. An individual can adjust the EMI amount as many times as required simply by the changing the online inputs in the EMI calculator.

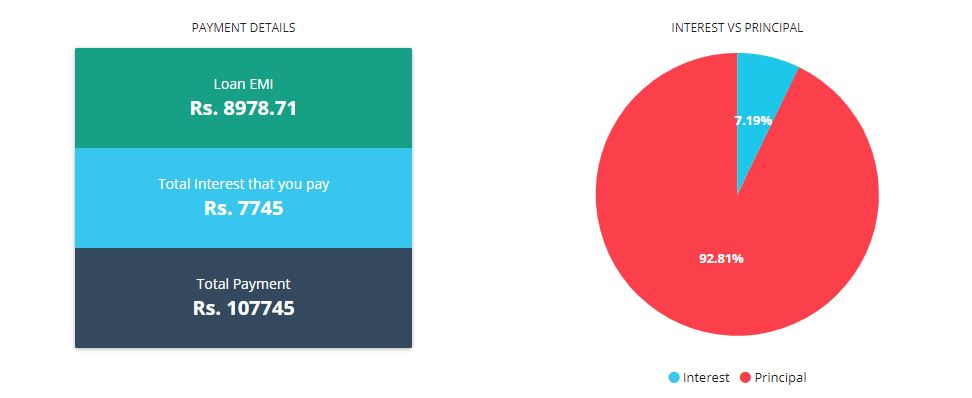

For example: An individual is in need of a household furniture and requires a personal loan of Rs. 1,00,000/- at an interest rate of 14% for 12 months. For such a purpose, using a personal EMI calculator, the individual can find out the rate of interest payable and the EMI amount payable every month. For the above illustration, the rate of interest will be calculated at Rs. 7,746/- for entire tenure of the personal loan and the EMI will be Rs. 8,979/-

Now if the Individual wants to pay an EMI less than Rs. 5000/-, then the period of repayment will have to be increased to 24 months. Then, by using the Personal EMI Calculator, the interest amount will be Rs. 15,233/- for entire 24 month period and the EMI will be Rs. 4,801/- which will be payable every month.

By using the EMI calculator for personal loans, an individual after determining his or her needed loan amount can find out the EMI payment most appropriate to the Individual as per his or her monthly income. Once the individual is ready with an apt EMI figure, he or she can now approach the bank of their choice to process the personal loan within minimal time.

Therefore, the EMI Calculator for personal loans online, is a handy tool to an individual for the purpose of establishing the EMI most fitting to him or her which ultimately serves as the most significant part of the personal loan. In the absence of such an online tool, the process will be long-drawn, requiring the borrower to make individual visits to multiple financial institutions in this preliminary stage, without any actual certainty of the loan being actually sanctioned at the end of the process.