Personal loans are a huge market these days with thousands of crores of rupees being disbursed every year by banks, financial institutions and private lenders to help borrowers tide over their needs. In older days, debt was considered taboo and hence the takers for personal loans were much lower than today. But with changing times, higher disposable incomes and growing requirements the entire scene has changed. So while a young IT professional in Bangalore might take a Cashkumar personal loan to buy a high end iPhone, some woman might take a personal loan in Mumbai to fund her foreign travel while a business man might take a personal loan in Delhi to fund his expansion.

So while being aware of its great use, you also need to monitor whether you have got a good personal loan and periodically check its health. Here are some of the factors you need to keep monitoring at the start and on a periodic basis about your personal loan:

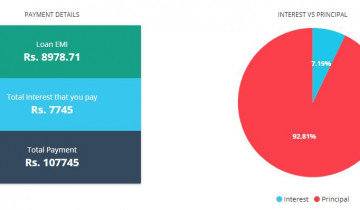

- Rate of Interest: What is the most important thing about a personal loan? It is the fact that you will have to pay it back…and pay back more than what you borrowed. The thing to monitor obviously is the rate of interest quite simply because the higher the rate of interest, the higher your EMIs. So always be sure that you get a loan from an institution which offers you a low rate of interest. Do not opt for the first one that offers you a loan but check your best deal here. Even otherwise after taking a loan, keep checking if some other bank is willing to offer a lower rate on a periodic basis.

- Pre-closure: As important a factor as interest rate is, there is another factor that you must always keep in mind which is the option of pre-closure. If you need money urgently and feel that you will get a big amount around the corner then look at a bank/NBFC which provides you with an option to pre-close with zero or minimal charges. This way you can avoid paying costly interest for a long period. There are also banks which offer the facility of part pre-payment if you expect to pay back small amounts annually. It might make sense to pay slightly higher interest rate if you think you can pre-close a loan. Compare between different interest rates using our EMI calculator here.

- Balance Transfer: The reason you should always monitor your debt and look at other deals is because most banks let you do a balance transfer with a small charge if you have paid a certain number of EMI’s. Your position in life always changes and there is a chance you get promoted or get a job with a high listed company. In such cases, due to an increase in your credit standing, other banks might be willing to offer you a lower interest rate on your loan. You can do a balance transfer and migrate with the same amount or with a top-up to a different bank and pay lower interest. So keep monitoring and looking for a better deal through our site here.

- EMIs: Never delay or default on your EMIs ever. Keep a check on the last day and dues along with any grace period provided by the bank. Try to pay the dues within that time to avoid getting your CIBIL score affected because any infraction is reported by the banks to CIBIL and a lower credit rating harms your chances of getting future loans. Even if you delay or default on a payment, make sure that you pay the amount in full by the next month as the original default always stays in that month and is not rolled over. If you default multiple times make sure to clear the whole outstanding in full and not settle with the bank for a lower amount. This will severely affect your CIBIL rating.

So take care and keep checking and be on top of these vital signs of your personal loan. It is a wonderful fiscal instrument which can be put to many uses but like a small fire which provides you with warmth, you also need to make sure that it doesn’t spread and burn down the house. Keep monitoring, ensure that you pay the least amount of interest and keep away from delays and defaults. Closely monitoring a personal loan can actually accrue you a lot of savings as well as eliminate any unwanted headaches.