The life style of a financially well-established individual is changing rapidly in this fast-paced world. Car models are changing, so are the styles of vacation, household décor and many such matters intimately related to life. Modern lifestyle demands can only be met with the help of personal loans

The life style of a financially well-established individual is changing rapidly in this fast-paced world. Car models are changing, so are the styles of vacation, household décor and many such matters intimately related to life. Modern lifestyle demands can only be met with the help of personal loans

There may be several reasons for a prospective borrower to seek a personal loan – possibly a significant renovation work or even to tide over some short term financial difficulties. Personal loans are the first loan product that comes to mind as it may be obtained without having to pledge any security or collateral against it. Most banks and financial institutions in India sanction a personal loan for up to 15 lakhs, depending on the borrower’s credit history and rating along with verification of the documentation submitted by the individual.

A personal loan is available from nationalized and private banks and other financial institutions like Non-Banking Finance Company or NBFCs. In order for an individual to apply for the loan, all banks and financial institutions have outlined a series of eligibility criteria that the prospective applicant needs to meet. The individual has to be a minimum of 21 years of age but not exceeding 60 years to be considered for a personal loan. His or her employment or business activity must have completed at least 2 to 3 years depending on the bank and the financial institution. In case of a salaried employee, the individual must remain employed in his or her current employment for at least 1 year. The minimum income required to be eligible for a personal loan varies from Rs. 4,000/- to Rs. 20,000/- depending on the criteria set by bank or the financial institution. Once -the individual fulfils all of these conditions, he or she is eligible to get a personal loan.

Now, the endeavour of the individual will be to ensure that he opts for the best personal loans and related products available in the market. The way forward is to visit -the websites of the banks or financial institutions and check and compare the information related to personal loans such as varying rates of interest for -along with the tenure of repayment. With the help of the EMI Calculator provided online by the banks and the financial institutions, one is able to determine one’s EMI payment on the required loan. The inputs such as the rate of interest and the duration for repayment will be able to determine the most suitable and affordable EMI for the individual in question.

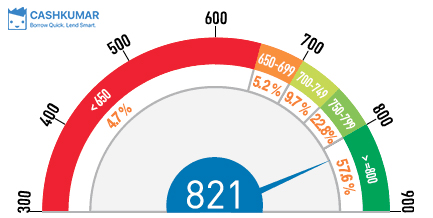

The crucial factor that will help the prospective borrower to get a personal loan sanctioned depends on the CIBIL score.

So, the question that comes to mind is – What is a CIBIL score? CIBIL is the short form of Credit Information Bureau (India) Limited. -the organization’s job is to assess the credit worthiness of an individual. It prepares a credit score basis the report on the credit worthiness of the individual. The banks and other financial institutions use this report to sanction a personal loan after considering the credit rating of the individual. Generally, for a personal loan of one lakh Indian Rupees, the credit score can vary from 350 to 500 depending on the bank and the financial institution. Therefore, having a reasonably good credit score is vital for the loan to get sanctioned.

It is very important for the individual who is desirous of getting a personal loan to keep track of the CIBIL score. The first priority with him or her is to obtain his or her CIBIL Report by paying a nominal charge from the Credit Information Bureau (India) Limited. It will be the primary checkpoint of the individual to determine whether any technical or typographical or simple errors has presented itself on the report which may possibly downgrade the credit score in any way. Then appropriate steps will have to be taken to get rid of those errors. This is one way of improving the CIBIL score.

In similar fashion, the prospective borrower needs to check if a loan which the individual has not taken, figures in his or her report. If that is so, then the individual will have to take up the matter with the CIBIL authorities and get the matter resolved. Once the matter is resolved the credit score too will increase.

Do not delay or miss any payments such as Credit Card payments, etc. This has the potential to damage your credit score rating. Therefore, being vigilant on this count will ensure that the individual’s credit rating remains steady and positive. In order to ensure timely payments, it is better to make such payments 5 working days before the due date so there is no scope of the payment being delayed.

One of the easiest ways to improve the credit score evaluation of an individual is by limiting credit utilization. By limiting the credit utilization of your credit card to 50% of the limit, the individual will always be on the safe zone. Moreover, an individual should always avoid multiple short-term loans or credit card applications. This gives the impression of credit hungriness which is acts as a deterrent for financial institutions when it comes to deciding on whether to approve or reject the individual’s loan application. This attitude may drop your credit value; hence, it is better to be steer clear of such practices.

All these steps if carefully adopted by an individual is bound to improve and positively impact on the CIBIL Score and rating which will ensure that the borrower has an easy passage for getting any personal loan sanctioned in the future.

You can get your approximate Credit Score using the link below,

https://cashkumar.com/blog/2015/09/23/how-to-check-cibil-score-free/