CASHKUMAR

CASHKUMAR

Credit Information Bureau (India) Limited

Cibil Score

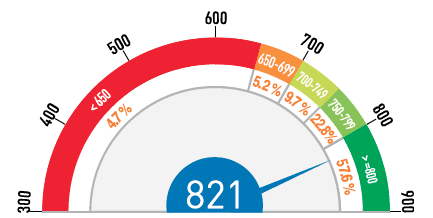

Figures indicate % of all new loans sanctioned during last 1 year falling in that score band

You can estimate your CIBIL Score by answering a few questions. Check your score now!

Check Free CIBIL ScoreCIBIL - Credit Information Bureau India Ltd, also known as Credit Bureau is India’s leading and reputed Credit Information Company. They collect and maintain loan and credit card payment records of individuals and commercial entities. These records are provided to them by banks and other financial institutions on a monthly basis. CIBIL will use this in generating Credit Information Report (CIR) and Credit Score for individuals and commercial entities. They provide these reports to lenders on request for the purpose of evaluating and approving loans.

CIBIL Score or credit score is a rating which indicates a person’s credit-worthiness. The score ranges from 300 to 900 and is derived by CIBIL through statistical algorithms that analyse an individual’s credit history from the past six months at least. This history includes loans, repayment patterns, defaults in repayment and other data relevant to a person’s credit-worthiness. Credit score plays an important role while applying for a loan; banks use this as a tool to mitigate default risk while lending. High score indicates that the borrower is credit-worthy and vice versa, high credit score will get you fast approvals on loan and even better interest rates.

CIR – Credit Information Report or CIBIL report has a record of all your past loans, credit card dues, repayment history, defaults in repayment, current outstanding on borrowed amount and so on from various banks and financial institutions over a period of time. A credit score is derived from the details available in the credit report post some algorithmic calculations.

| Score | Analysis | Apply for Loan |

|---|---|---|

| -1 | This indicates that the borrower has no credit history; he has never borrowed nor owns a credit card from any financial institution. | Apply with Cibil -1 |

| 300 - 600 | This indicates multiple defaults, overdue payments and write-offs on previous loans and credit card payments. It is very hard to obtain a loan for someone in this bracket from banks and financial institutions. The loan applications will be rejected in most cases as this score is considered to be a credit risk with higher chances of default. | Apply with Cibil 300 - 600 |

| 600 - 750 | This indicates there are instances of late payments and irregularity of payments against loans and credit cards in the past. It is neither a bad score nor a good one. Banks and financial institutions will be cautious and might perform additional credit check to gauge the credit-worthiness of the individual. They might demand guarantors, security or collateral if necessary before sanctioning the loan. Banks and financial institutions might charge a higher rate of interest in such cases. | Apply with Cibil 600 - 750 |

| 750 - 900 | This is a positive indicator for the banks and financial institutions to approve loans, both secured and unsecured. This signifies that you have never defaulted and have been consistent in repaying your previous loans or credit card bills. Banks will be more than happy to advance you a loan which will help you negotiate for lower interest rates, processing fees and pre-closure charges. | Apply with Cibil 750 - 900 |

| NA or NH | This indicates that you do not have a credit history, credit records are available for less than 6 months or you do not have a credit card. This score isn’t necessarily bad, but few banks or financial institutions will lend loans to a first time borrower or an applicant with no credit history because they cannot gauge the risk. | Apply with Cibil NA or NH |

You can get your CIBIL Scores and CIR online through the official CIBIL website https://www.cibil.com. Here are the steps to follow,

You can also follow the manual approach to buy your credit score by downloading and mailing a request form to CIBIL.

Fill all the required details and mail the form with self-attested KYC documents, a Demand Draft(DD) of 500/- to the address mentioned in the request form.

Your credit score will be mailed to you within 7 business days post verification.

Note* - KYC details and requirements are also available on the official website of CIBIL.

Correcting your CIBIL Score is not a cake walk, it will take a few years to improve the credit score. You need to be patient, follow the tips given below and be consistent in your efforts. It is also important to follow this financial disciple once you have achieved a good credit score to maintain it further.

Repayments on a loan account for 35% of your credit score, so missing out on EMIs and credit card bills will hurt you a lot with respect to the credit score. It is really important to maintain financial discipline and service your loans well by paying EMIs on time to keep your credit score intact. Missing one or two payments which you have paid subsequently will hurt your credit score temporarily, but anything more than that can have a bad impact.

If you repay the delayed EMI or a credit card bill within 90 days, it will have a minor impact but any delay of more than 90 days is unacceptable. Banks will mark this as a Non performing asset (NPA) which will negatively impact your credit score.

The effect also depends on the timing of the delay. It is a red flag for banks if you have missed payments in the last six months before applying for a new loan as it indicates that there are chances you could default. If you have delayed one or two payments in the past and have caught up with them quickly and made sure the subsequent EMIs are paid on time, your credit score will eventually bounce back.

However, your credit score will be lower if your CIR shows that you have missed a few payments. Most credit card companies conduct a quarterly review of the credit score. If they see a deteriorating pattern on your credit score, they will take actions such as reducing your credit limit, not offering you additional loans or fresh loans. Therefore it is always good to pay your EMIs and credit card bills well before your salary date to maintain good credit score which will help secure loans in the future.

Have you ever borrowed more than you can service? Have you ever defaulted on your EMIs or credit card bill? If so, you are sure to get a call from the bank to SETTLE this amount and get out of the debt trap. They do this by asking you to pay a discounted amount against the loan. You might think this is the best option at that point in time, but hold on! This might get your credit score in a real bad shape.

First, let us understand what is Settled and Written Off

When you are in a debt trap and unable to make the payments on your debt, banks will provide you with an option pay a lumpsum. This is a part amount in lieu of the total amount required to close the loan. It is usually initiated when you have defaulted for more than six months. This amount is negotiable with the lender based on your financial stand but it will not be less than the principal in most of the cases.

Written off is an instance where you have defaulted on most of your EMIs and in a state where you are unable to pay even the settlement amount. Banks usually write off loans 180-270 days after the payment date. Banks then receive the amount you can pay them and write off the rest and report this as a loss.

The settlement can happen both before and after the write-off as also when there is a dispute between the lender and the borrower regarding the loan. Even when the settlement is done, make sure the rest of the amount is written off by the bank otherwise this keeps accruing and adding up to higher amounts hurting your credit score even more. This might happen when banks don’t follow the right procedure or when their reporting in incorrect.

How does this affect your CIBIL Score?

Banks report your credit status to CIBIL every month. If you have started defaulting on any of your EMIs or bills this will be reported to CIBIL routinely and your CIBIL Score would have started to decrease. Banks would again report to CIBIL when you accept a settlement offer and this will be reflected on your CIBIL report as settled. In the case of a write off, the CIBIL report would have a comment ‘written off’ against the loan.

As a settlement or write off imply that that customer has not been able to pay past dues, banks will terminate all relationships with the customer and include them on a blacklist for atleast 7 years. This will prevent you from getting any loan in the future and your CIBIL Score would drop drastically.

The conclusion is never go for settlement and always pay your dues completely and pay them on time. If you have ever gone for settlement and hence suffering from a low CIBIL Score, the first step is to pay the due amount to the bank and get the settled or write off flag off your credit report.

However, this will not instantly improve your credit history. The credit report's DPD (days past due) section will continue to show that you had defaulted. The DPD section carries information on dues for the past 36 months. This means even after you pay the full amount, the credit report will continue to show for 36 months the period for which you had defaulted. Only after following good financial discipline for the next few years ca you expect your credit score to improve.

CIBIL Score or credit score is a rating which indicates a person’s credit-worthiness. This score is derived by CIBIL through statistical algorithms using an individual’s credit history for atleast the past six months which includes loans, repayment patterns, defaults in repayment and other data relevant to a person’s credit-worthiness. Credit score plays an important role while applying for a loan; banks use this as a tool to mitigate default risk while lending. High score indicates that the borrower is credit-worthy and vice versa. A high credit score will also get you easy and instant approvals on loan and even lower interest rates.

Banks will depend on this score greatly while lending unsecured loans such as personal loans, credit cards, travel loans, wedding loans etc when compared to secured loans. As unsecured loans have no collateral, banks need to make sure that they not lending to an individual who is unreliable and the only way banks can assess this is through a credit score.

Banks check the following things in your CIBIL report before sanctioning a loan:

So, if you are planning to apply for a loan, it is important that you are aware of your credit history and current score. Different banks have different bandwidth on the score and approval also depends on the type of loan you are applying for (secured or unsecured). Plan ahead and request a copy of your history and score several weeks prior to your application. Review your credit history for accuracy and give yourself time to correct any errors in your history report. Lenders today will rely heavily on your past usage of credit and if there are mistakes on your report, you may end up with a lower score which can hurt your chances of loan approval. If you have never borrowed nor have a credit card, you will be CIBIL -1 and you will not have a credit report. Banks usually don’t advance unsecured loans to a first time borrower. Therefore apply for a credit card and use it for atleast six – seven months by making regular repayments and then apply for a loan. Consider your financial limitations when planning for a loan and apply for the loan based on your ability to make repay.

According to CIBIL findings, the following is the brief on percentage of loan sanctioned based on credit scores last year.

According to these findings, you will not get a loan if your score is below 650. Higher the score, better your chances of getting a loan and you can even negotiate the interest rates if your credit score is good.